Creating a budget is an essential part of managing your finances. A budget planning worksheet can help you organize your expenses and income, allowing you to see where your money is going and make necessary adjustments. By using a budget planning worksheet, you can take control of your finances and work towards achieving your financial goals.

It’s important to have a clear understanding of your financial situation before creating a budget. A budget planning worksheet can help you track your expenses, identify areas where you can cut back, and set realistic financial goals. By taking the time to create a budget plan, you can better manage your money and avoid unnecessary debt.

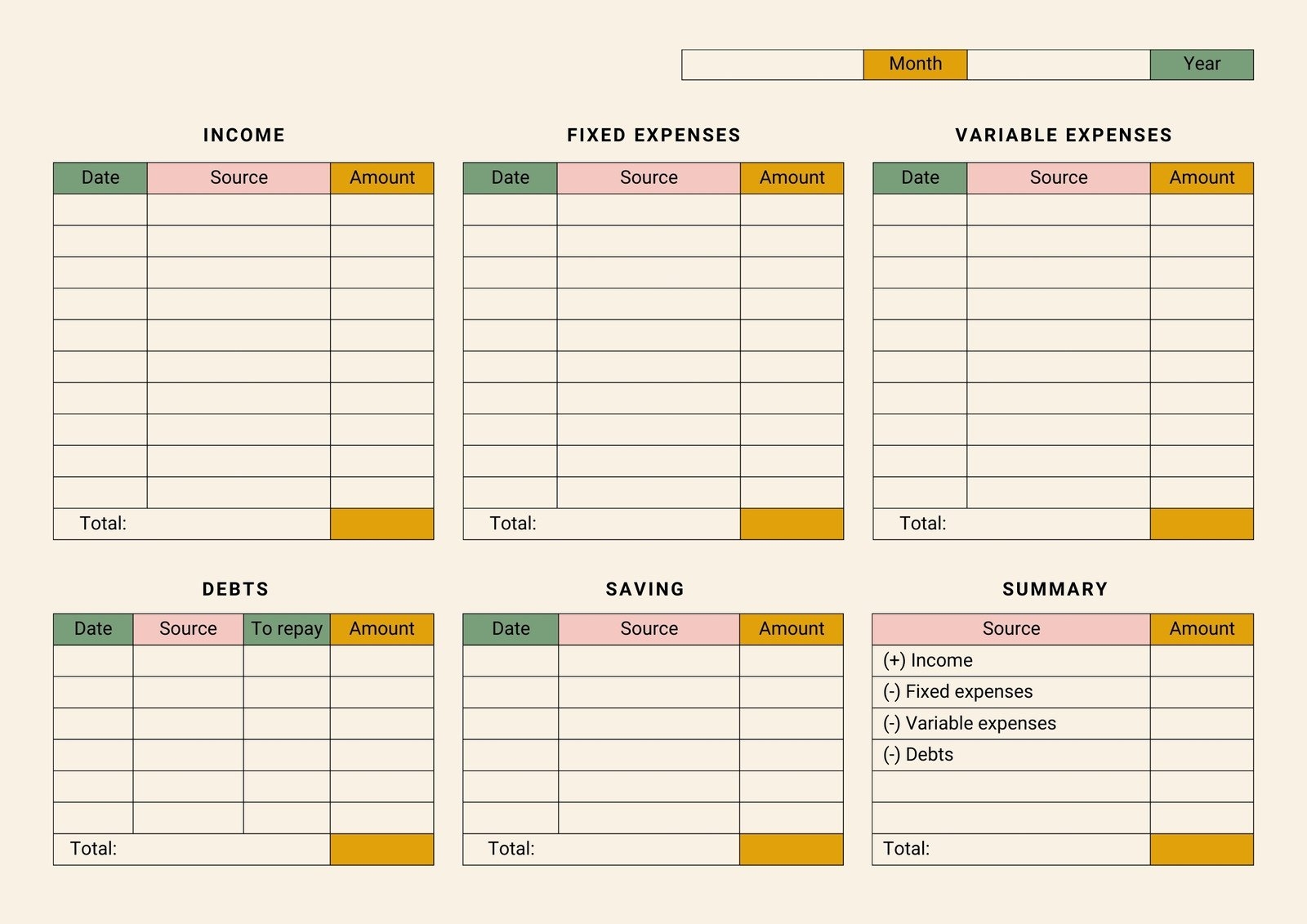

When creating a budget planning worksheet, start by listing all of your sources of income, including your salary, bonuses, and any other sources of income. Next, list all of your monthly expenses, including bills, groceries, entertainment, and savings. Be sure to include both fixed expenses, such as rent or mortgage payments, and variable expenses, such as dining out or shopping.

Once you have listed all of your income and expenses, subtract your total expenses from your total income to determine your monthly surplus or deficit. If you have a surplus, consider putting the extra money towards savings or paying off debt. If you have a deficit, look for areas where you can cut back on spending to balance your budget.

Regularly review and update your budget planning worksheet to ensure that you are staying on track with your financial goals. Make adjustments as needed to accommodate changes in your income or expenses. By consistently monitoring your budget, you can make informed financial decisions and work towards achieving financial stability.

In conclusion, a budget planning worksheet is a valuable tool for managing your finances and reaching your financial goals. By creating a budget plan and tracking your income and expenses, you can take control of your money and make smarter financial decisions. Start using a budget planning worksheet today to improve your financial well-being.