When starting a new job, one of the first things you will need to do is fill out a W4 form. This form helps your employer determine how much federal income tax to withhold from your paycheck. To accurately complete this form, you may need to use a W4 worksheet calculator to calculate your allowances and deductions.

Understanding how to use a W4 worksheet calculator can help you ensure that the correct amount of taxes is withheld from your paycheck. This will help you avoid owing money at tax time or receiving a large refund.

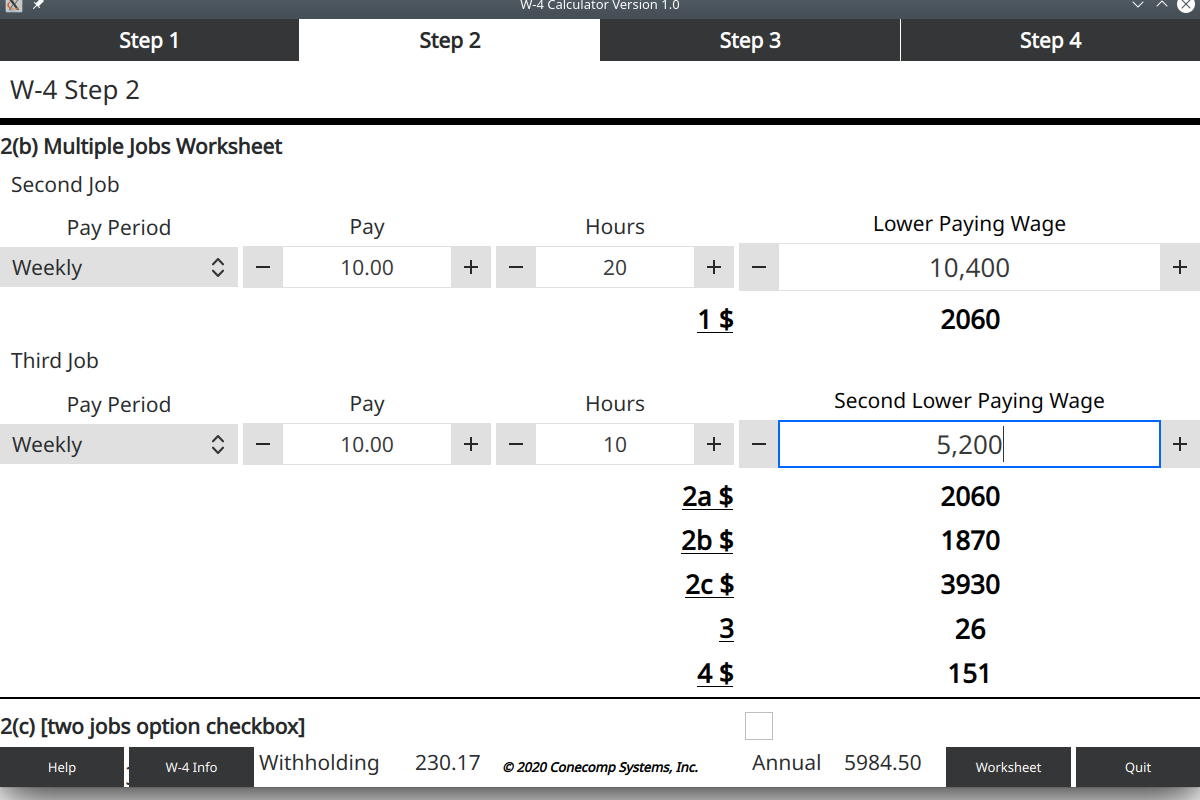

W4 Worksheet Calculator

A W4 worksheet calculator is a tool that helps you determine the number of allowances you should claim on your W4 form. The calculator takes into account factors such as your filing status, income, deductions, and credits to provide you with an accurate withholding amount.

When using a W4 worksheet calculator, you will need to gather information such as your total income, number of dependents, and any deductions or credits you qualify for. By inputting this information into the calculator, you can determine the appropriate number of allowances to claim on your W4 form.

It’s important to note that your tax situation may change throughout the year, so it’s a good idea to revisit the calculator periodically to ensure that you are still withholding the correct amount from your paycheck.

By using a W4 worksheet calculator, you can take control of your tax withholding and ensure that you are not overpaying or underpaying your taxes. This can help you avoid any surprises come tax time and make sure you are getting the most out of your paycheck.

Overall, a W4 worksheet calculator is a valuable tool for anyone who wants to accurately calculate their tax withholding. By using this tool, you can ensure that you are on track with your taxes and avoid any potential penalties or surprises.