As we approach the new tax year in 2024, it is important for individuals and businesses to start preparing their tax computations. The tax computation worksheet for 2024 will help calculate the amount of tax owed to the government based on income, deductions, and credits. This worksheet is a valuable tool in ensuring accurate and timely tax filings.

With the ever-changing tax laws and regulations, it can be challenging to stay up-to-date with the latest tax rates and deductions. The tax computation worksheet for 2024 provides a clear and organized way to calculate taxes owed, making the process less daunting for taxpayers. By following the guidelines outlined in the worksheet, individuals and businesses can ensure they are meeting their tax obligations while taking advantage of any available tax breaks.

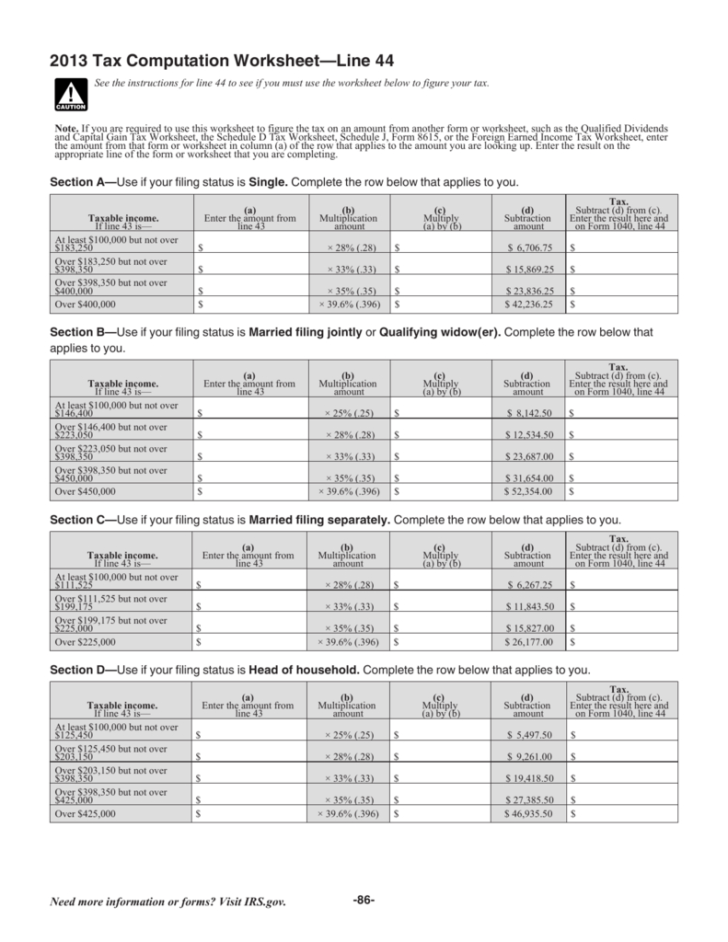

The tax computation worksheet for 2024 includes sections for income sources, deductions, credits, and tax rates. Taxpayers will need to input their income from various sources such as wages, investments, and rental properties. They will also need to account for any deductions they are eligible for, such as mortgage interest, charitable contributions, and student loan interest. Additionally, taxpayers can claim credits for expenses such as education, child care, and energy-efficient home improvements.

Once all income, deductions, and credits have been entered into the worksheet, the tax computation will calculate the total tax owed based on the applicable tax rates for the year 2024. Taxpayers can then compare this amount to any tax payments already made throughout the year to determine if they owe additional taxes or are entitled to a refund. The worksheet serves as a valuable tool in helping taxpayers understand their tax liabilities and plan accordingly.

In conclusion, the tax computation worksheet for 2024 is an essential tool for individuals and businesses to accurately calculate their tax liabilities. By utilizing this worksheet, taxpayers can ensure they are complying with tax laws while maximizing their tax savings through deductions and credits. As the tax year progresses, it is crucial to keep track of income and expenses to complete the worksheet accurately and on time.