When it comes to filing taxes, dependents play a crucial role in determining the amount of deductions you are eligible for. The standard deduction for dependents is an important aspect of tax preparation that can help reduce your taxable income. By understanding how to use the standard deduction worksheet for dependents, you can ensure that you are maximizing your deductions and minimizing your tax liability.

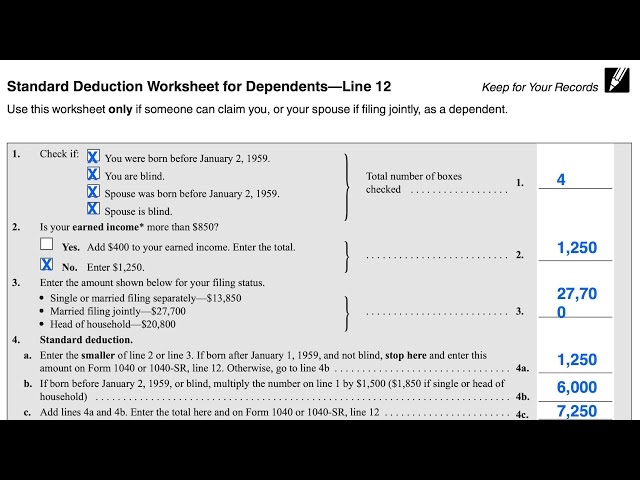

The standard deduction worksheet for dependents is a tool provided by the IRS to help individuals calculate the amount of their standard deduction. This worksheet takes into account various factors such as your filing status, age, and whether you are claimed as a dependent on someone else’s tax return. By filling out this worksheet accurately, you can determine the standard deduction amount that you are eligible for.

When filling out the standard deduction worksheet for dependents, it is important to pay attention to the specific instructions provided by the IRS. You will need to provide information such as your gross income, adjustments to income, and any deductions or credits that you are eligible for. By following the worksheet step by step, you can ensure that you are accurately calculating your standard deduction.

One key factor to consider when using the standard deduction worksheet for dependents is whether you are eligible to be claimed as a dependent on someone else’s tax return. If you meet the criteria to be claimed as a dependent, your standard deduction may be limited or reduced. It is important to understand how your dependent status impacts your standard deduction and to accurately reflect this on the worksheet.

By utilizing the standard deduction worksheet for dependents, you can take advantage of the deductions available to you as a dependent. This can help lower your taxable income and potentially reduce the amount of taxes you owe. By carefully completing the worksheet and following the instructions provided, you can ensure that you are maximizing your deductions and taking full advantage of the tax benefits available to you as a dependent.

In conclusion, the standard deduction worksheet for dependents is a valuable tool that can help individuals accurately calculate their standard deduction and reduce their tax liability. By understanding how to use this worksheet effectively and following the guidelines provided by the IRS, you can ensure that you are taking full advantage of the deductions available to you as a dependent.