When it comes to taxes, Social Security benefits can sometimes be a confusing topic. Many people wonder if their Social Security benefits are taxable and how much of it will be subject to taxation. In order to determine the taxable portion of your Social Security benefits, you may need to use the Social Security Taxable Income Worksheet provided by the IRS.

The Social Security Taxable Income Worksheet is a tool used to calculate how much of your Social Security benefits are subject to taxation. This worksheet takes into account your total income, including half of your Social Security benefits, to determine the taxable portion. It is important to fill out this worksheet accurately to ensure you are paying the correct amount of taxes on your benefits.

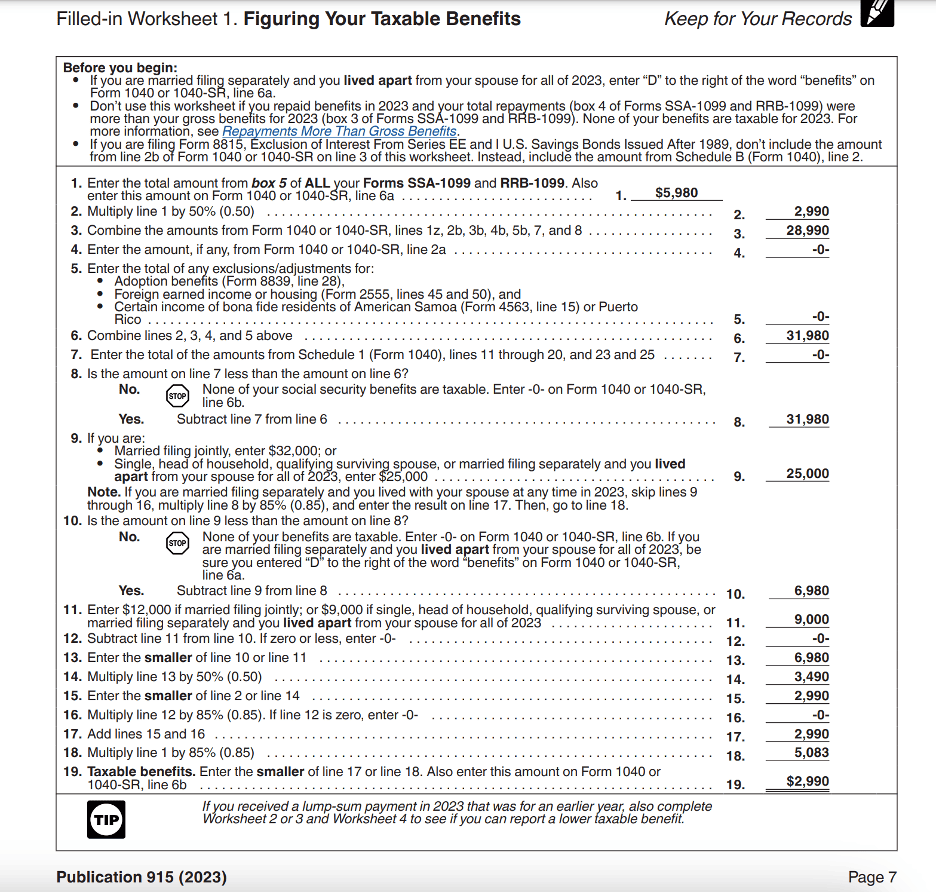

Social Security Taxable Income Worksheet

When filling out the Social Security Taxable Income Worksheet, you will need to gather information about your total income for the year. This includes wages, self-employment income, interest, dividends, and any other sources of income. You will also need to know the total amount of your Social Security benefits received during the year.

Once you have gathered all the necessary information, you can begin filling out the worksheet. The worksheet will guide you through the calculations needed to determine the taxable portion of your Social Security benefits. It is important to follow the instructions carefully and double-check your work to ensure accuracy.

After completing the worksheet, you will have a clear understanding of how much of your Social Security benefits are subject to taxation. This information will be used when filing your taxes to ensure you are paying the correct amount of taxes on your benefits. By using the Social Security Taxable Income Worksheet, you can avoid any surprises when it comes time to file your taxes.

In conclusion, the Social Security Taxable Income Worksheet is a valuable tool for calculating the taxable portion of your Social Security benefits. By accurately filling out this worksheet, you can ensure you are paying the correct amount of taxes on your benefits. If you are unsure about how to use the worksheet or have questions about the taxation of your Social Security benefits, it is always best to consult with a tax professional for guidance.