When it comes to understanding your taxes, the Social Security tax worksheet plays a crucial role in determining how much you owe. Social Security taxes are collected from both employees and employers to fund the Social Security program, which provides benefits to retirees, disabled individuals, and survivors of deceased workers. The worksheet helps calculate the amount of Social Security tax that needs to be withheld from an employee’s paycheck.

The Social Security tax worksheet is a tool provided by the Internal Revenue Service (IRS) to help employers and employees determine the correct amount of Social Security tax to withhold. It takes into account factors such as the employee’s income, filing status, and any additional withholding allowances claimed on their W-4 form. By using this worksheet, both employers and employees can ensure that the correct amount of Social Security tax is being withheld.

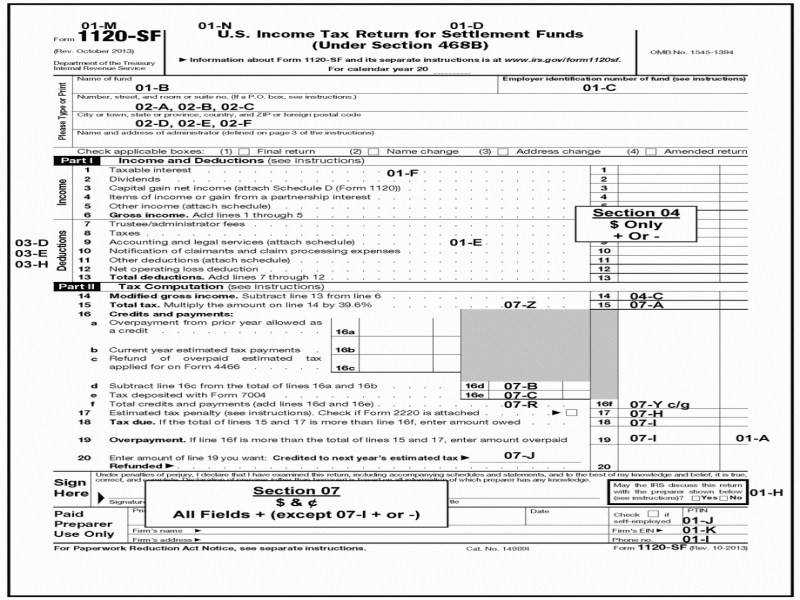

Social Security Tax Worksheet

One of the key components of the Social Security tax worksheet is the calculation of the Social Security tax rate. As of 2021, the Social Security tax rate is set at 6.2% for both employees and employers, up to a certain income limit. The worksheet helps determine the amount of income subject to this tax and calculates the total tax liability for the year.

In addition to calculating the Social Security tax rate, the worksheet also takes into account any additional Medicare tax that may be owed. The Medicare tax rate is set at 1.45% for both employees and employers, with an additional 0.9% for high-income earners. By using the worksheet, individuals can ensure that the correct amount of Medicare tax is also being withheld from their paycheck.

Overall, the Social Security tax worksheet is a valuable tool in helping individuals understand and calculate their Social Security tax obligations. By accurately completing the worksheet, employees can ensure that the correct amount of tax is being withheld from their paycheck, helping them avoid any surprises come tax time.

In conclusion, the Social Security tax worksheet is an essential tool for both employers and employees to accurately determine the amount of Social Security and Medicare tax that needs to be withheld. By utilizing this worksheet, individuals can ensure compliance with tax laws and avoid any potential penalties for underpayment. Understanding how to use the worksheet can help individuals better manage their finances and plan for their tax liabilities.