When it comes to filing taxes, understanding the different worksheets and forms can be overwhelming. One important worksheet to be aware of is the Social Security Income Tax Worksheet. This worksheet helps taxpayers calculate the amount of Social Security benefits that are subject to income tax.

Many retirees rely on Social Security benefits as a major source of income during retirement. It’s crucial to understand how these benefits are taxed in order to properly plan for taxes and avoid any surprises come tax time.

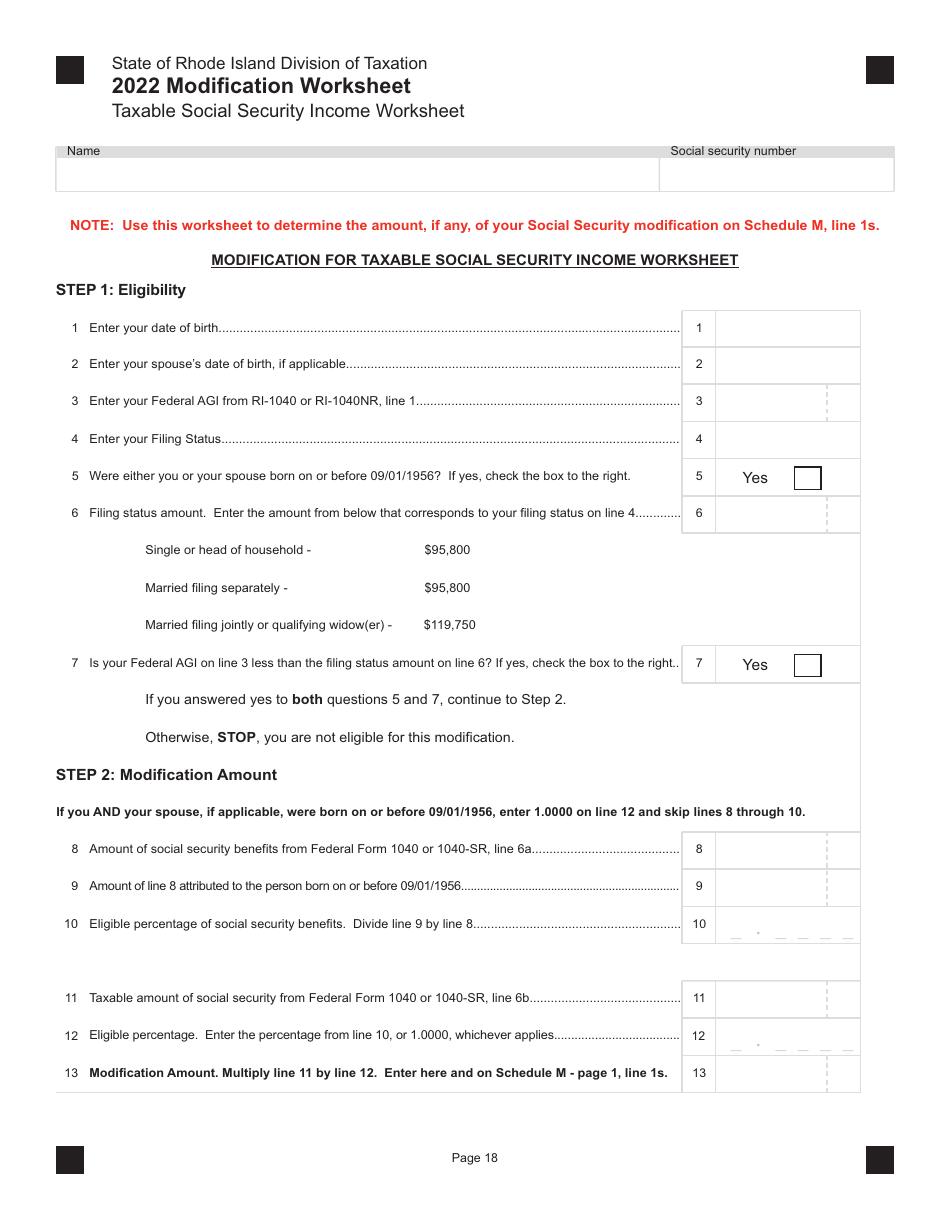

Social Security Income Tax Worksheet

The Social Security Income Tax Worksheet is used to determine the taxable portion of your Social Security benefits. The worksheet takes into account your filing status, total income, and half of your Social Security benefits to calculate the taxable amount. It’s important to note that not all Social Security benefits are subject to income tax, and the worksheet helps determine the portion that is taxable.

Once you have filled out the worksheet and calculated the taxable portion of your Social Security benefits, you can then use this information to determine if you owe any taxes on your benefits. Depending on your total income and filing status, you may owe taxes on a portion of your Social Security benefits.

It’s important to review the Social Security Income Tax Worksheet carefully and accurately input all necessary information to ensure that you are calculating the correct taxable amount. Making a mistake on this worksheet could result in errors on your tax return and potential penalties from the IRS.

Overall, understanding the Social Security Income Tax Worksheet is essential for retirees who receive Social Security benefits. By knowing how to calculate the taxable portion of your benefits, you can better plan for taxes and avoid any surprises when it comes time to file your tax return.

In conclusion, the Social Security Income Tax Worksheet is a valuable tool for determining the taxable portion of your Social Security benefits. By accurately completing this worksheet, you can ensure that you are properly reporting your income and avoiding any potential tax issues. It’s important to consult with a tax professional if you have any questions or concerns about how to properly fill out this worksheet.