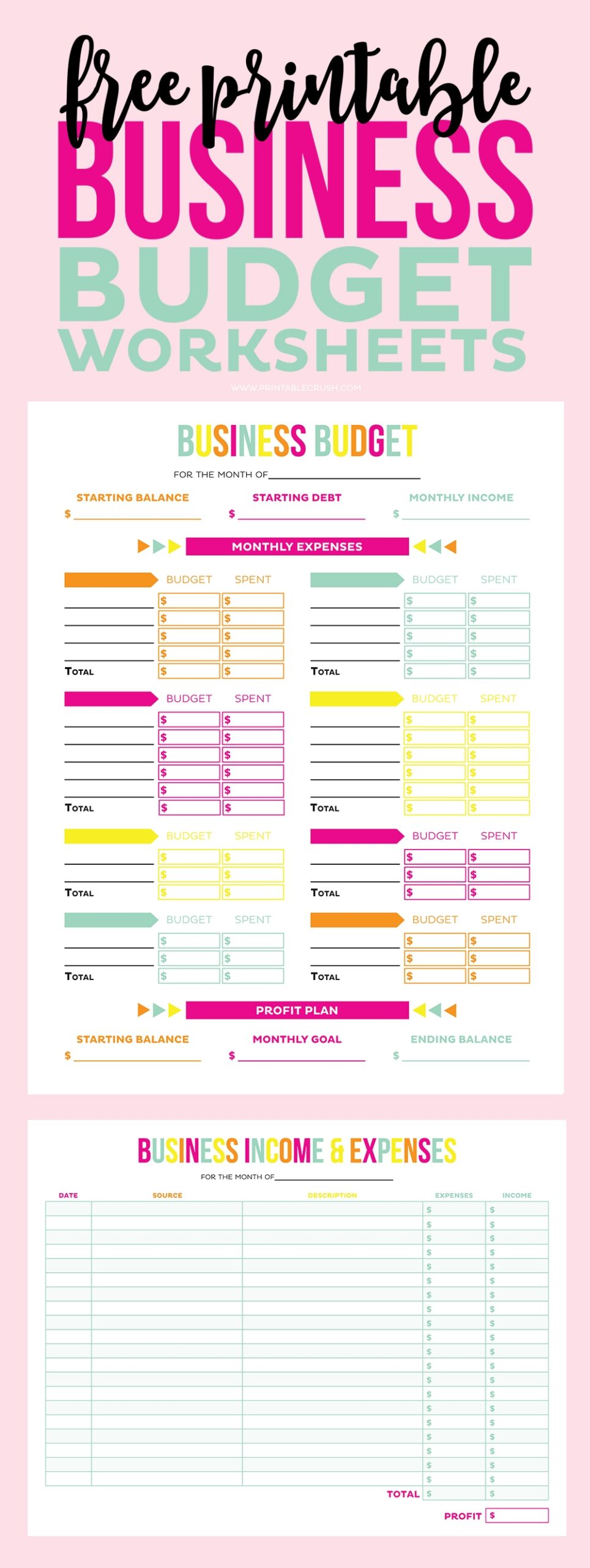

Managing finances is crucial for the success of any small business. One tool that can help in this process is a small business budget worksheet. This worksheet allows business owners to track their income and expenses, helping them make informed decisions about their financial health.

Creating a budget worksheet can help small business owners understand where their money is going and identify areas where they can cut costs or increase revenue. By tracking their finances in a structured way, businesses can plan for the future and ensure they are on track to meet their financial goals.

Benefits of a Small Business Budget Worksheet

A small business budget worksheet provides a clear overview of the financial health of the business. It helps business owners track their income sources, expenses, and cash flow, allowing them to identify any areas of concern or opportunities for growth. By using a budget worksheet, small business owners can make informed decisions about their finances and plan for the future.

Furthermore, a budget worksheet can help small business owners prioritize their spending and allocate resources effectively. By setting financial goals and tracking progress towards them, businesses can ensure they are on track to meet their objectives. A budget worksheet can also help business owners prepare for unexpected expenses or economic downturns, ensuring they have a financial safety net in place.

In addition, a small business budget worksheet can help business owners identify trends in their finances and make adjustments as needed. By regularly reviewing their budget worksheet, businesses can spot any discrepancies or areas of overspending, allowing them to take corrective action before it becomes a major issue. This proactive approach to financial management can help small businesses thrive in a competitive market.

In conclusion, a small business budget worksheet is a valuable tool for managing finances and planning for the future. By tracking income and expenses in a structured way, business owners can make informed decisions about their financial health and ensure they are on track to meet their financial goals. With the help of a budget worksheet, small businesses can prioritize spending, identify opportunities for growth, and prepare for unexpected expenses, setting themselves up for long-term success.