When it comes to filing taxes as a self-employed individual, the Schedule C worksheet plays a crucial role in determining your business income and expenses. This form is used to report income or losses from a sole proprietorship, independent contractor work, or other forms of self-employment. Understanding how to fill out this worksheet correctly can help you maximize your deductions and minimize your tax liability.

As a self-employed individual, it is important to keep accurate records of your business income and expenses throughout the year. The Schedule C worksheet allows you to report these figures in an organized manner, making it easier to calculate your net profit or loss. By taking the time to complete this form accurately, you can ensure that you are not overpaying or underpaying your taxes.

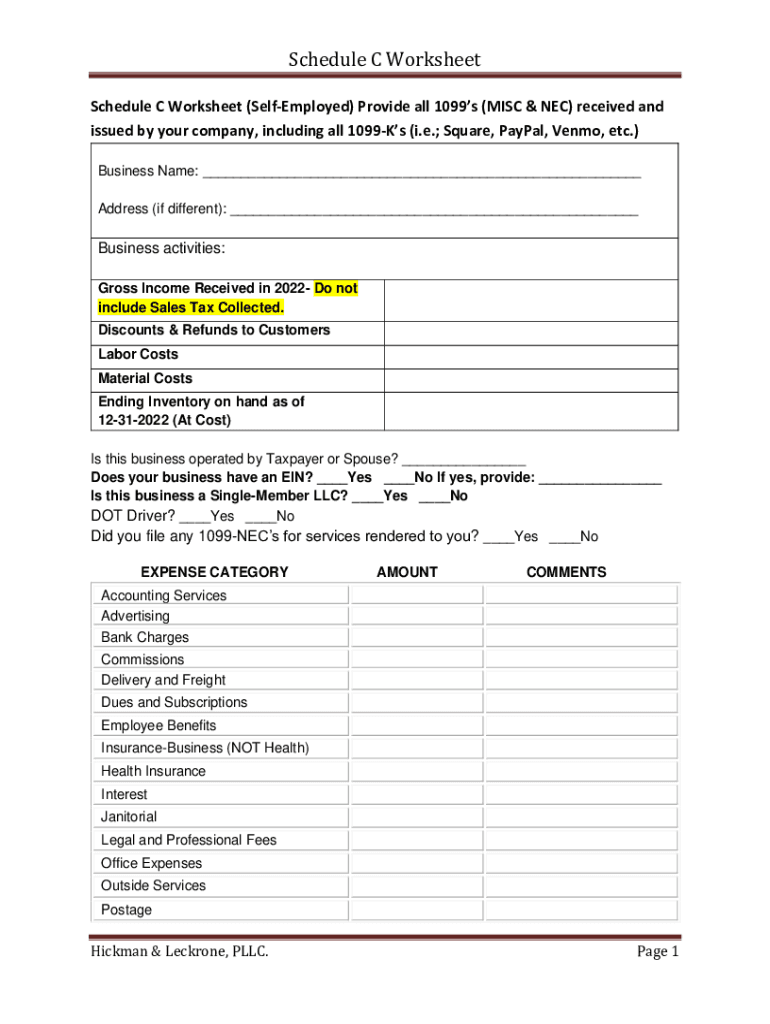

Schedule C Worksheet

When filling out the Schedule C worksheet, you will need to provide detailed information about your business income and expenses. This includes listing your gross receipts, cost of goods sold, and various categories of expenses such as advertising, utilities, and office supplies. You will also need to calculate your net profit or loss for the year, which will ultimately determine how much you owe in taxes.

One of the key benefits of the Schedule C worksheet is that it allows you to deduct business expenses from your taxable income. By keeping thorough records of your expenses, you can take advantage of deductions for things like business mileage, equipment purchases, and home office expenses. These deductions can help reduce your overall tax burden and increase your bottom line.

It is important to note that the IRS may audit your Schedule C if they suspect inaccuracies or discrepancies in your reporting. To avoid any potential issues, be sure to keep detailed records of all your business transactions and expenses. By staying organized and thorough in your record-keeping, you can confidently fill out the Schedule C worksheet and submit your tax return with confidence.

In conclusion, the Schedule C worksheet is a valuable tool for self-employed individuals to report their business income and expenses accurately. By understanding how to fill out this form correctly and keeping thorough records throughout the year, you can maximize your deductions and minimize your tax liability. Take the time to complete the Schedule C worksheet carefully, and you can ensure that you are in compliance with IRS regulations while maximizing your tax savings.