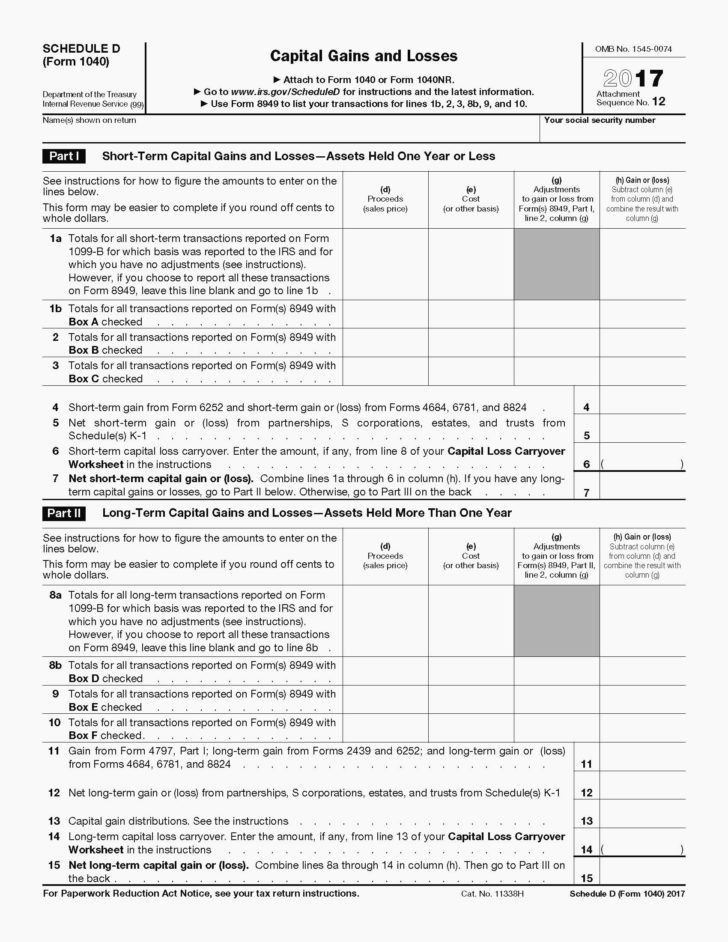

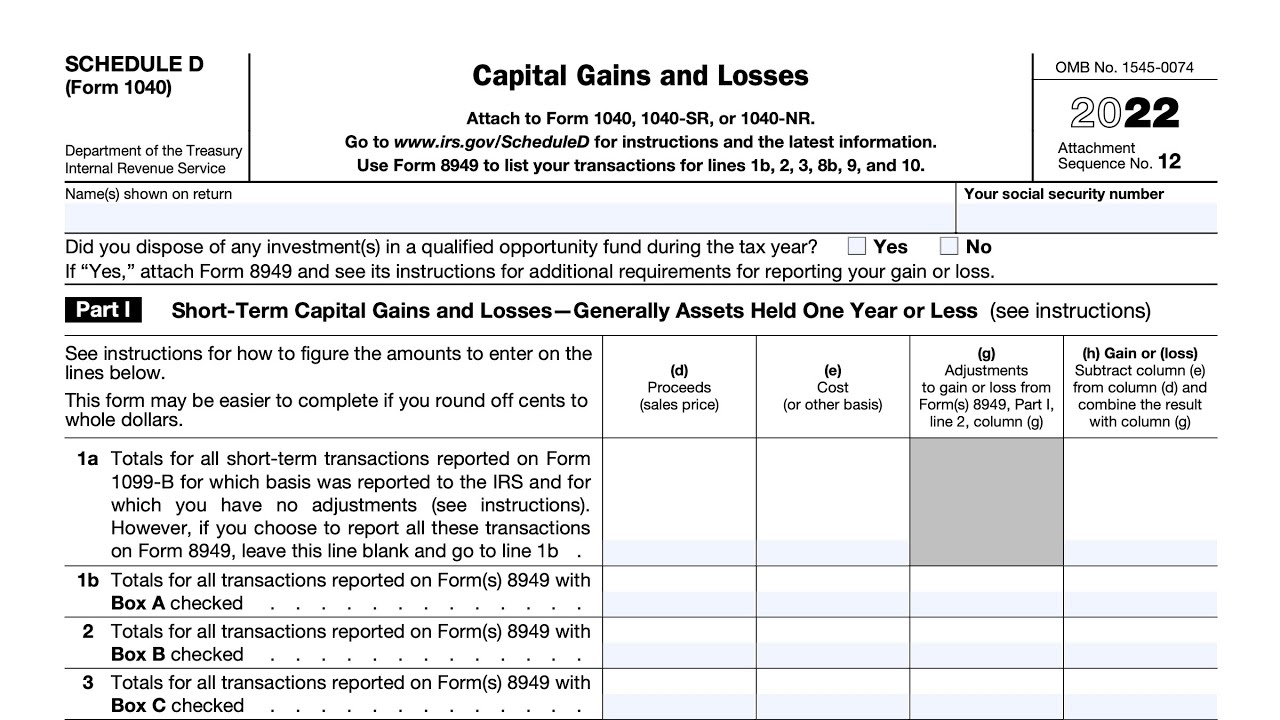

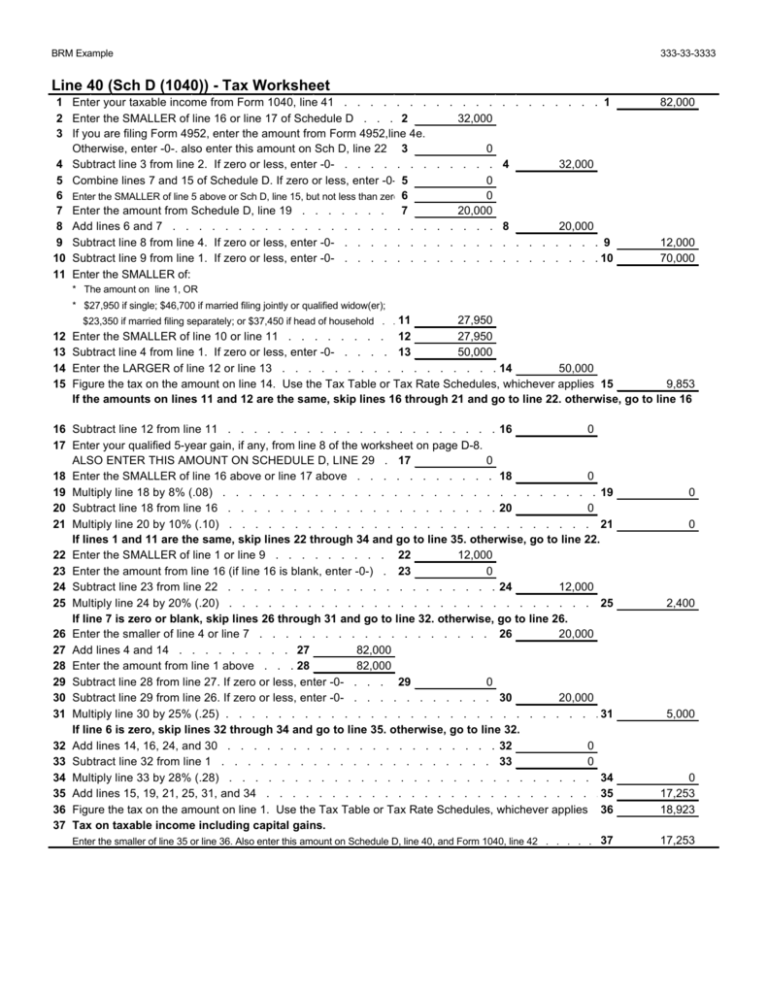

When it comes to filing your taxes, Schedule D is the form you’ll use to report your capital gains and losses. This form is used to calculate the amount of tax you owe on any profits you made from selling investments such as stocks, bonds, or real estate. The Schedule D Tax Worksheet is an essential tool that helps you determine the taxable amount of your capital gains and losses.

Using the Schedule D Tax Worksheet, you will need to gather information on the cost basis of your investments, the sales proceeds, and any adjustments or deductions that may apply. It’s important to accurately fill out this worksheet to ensure that you are not overpaying or underpaying your taxes on capital gains.

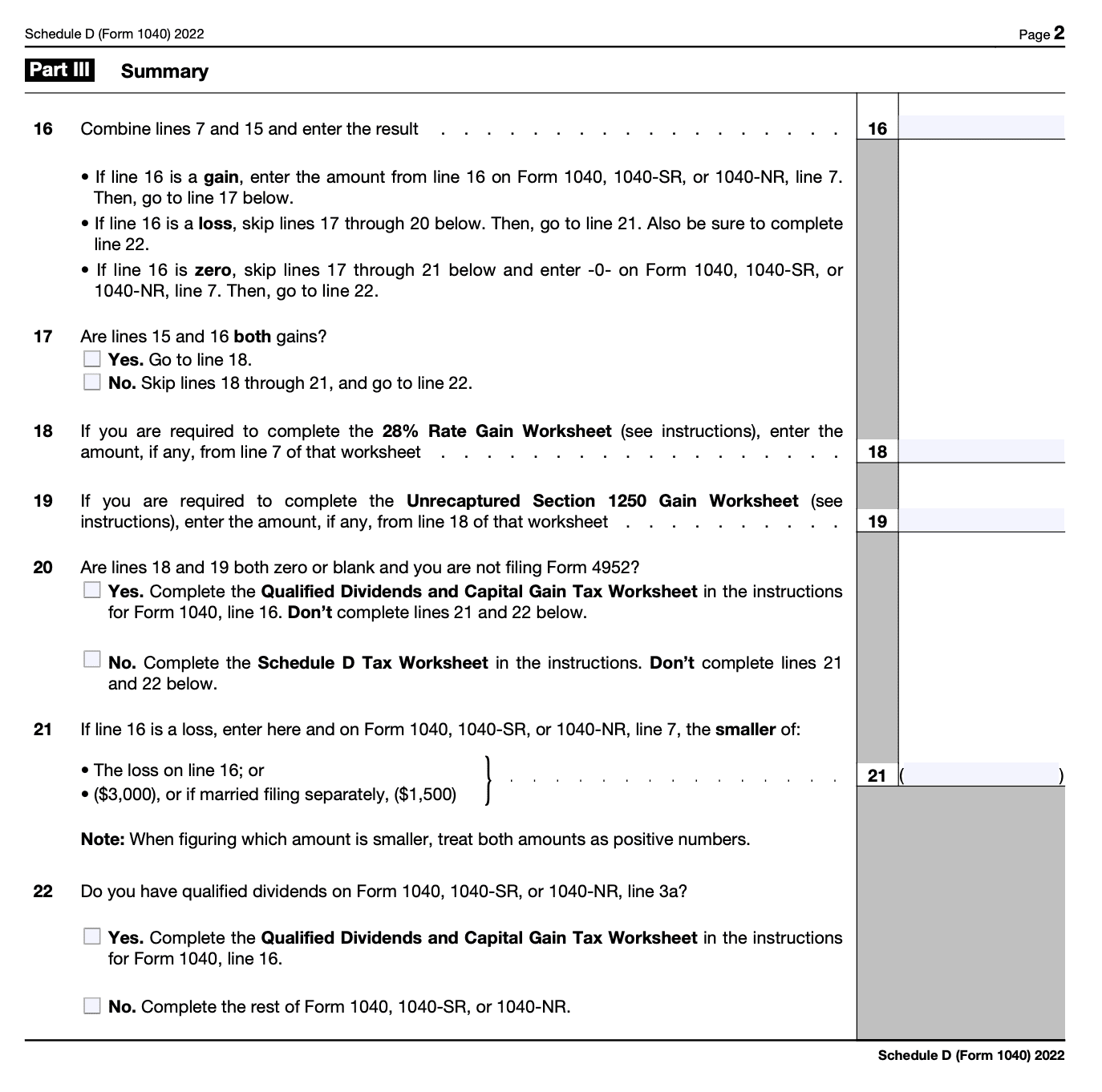

One of the key components of the Schedule D Tax Worksheet is the calculation of your net capital gains or losses. This is done by subtracting your total capital losses from your total capital gains. If you have a net capital gain, this amount will be added to your taxable income. If you have a net capital loss, you may be able to deduct up to $3,000 of this loss from your other income.

Additionally, the Schedule D Tax Worksheet includes a section for reporting any capital gains distributions you may have received from mutual funds or other investments. These distributions are typically taxed at a lower rate than ordinary income, so it’s important to accurately report them on your tax return.

Finally, the Schedule D Tax Worksheet also includes instructions for reporting any carryover losses from previous years and calculating the amount of tax you owe on your net capital gains. By following the instructions on the worksheet carefully, you can ensure that you are accurately reporting your capital gains and losses and paying the correct amount of tax.

In conclusion, the Schedule D Tax Worksheet is a vital tool for calculating the tax owed on your capital gains and losses. By accurately filling out this worksheet and following the instructions provided, you can ensure that you are properly reporting your investment income and paying the correct amount of tax to the IRS.