Investing in the stock market or selling property can result in capital gains, which are profits made from the sale of assets. Calculating capital gains accurately is important for tax purposes and financial planning. A capital gains worksheet can help individuals track and calculate their gains and losses, making the process easier and more organized.

Whether you are a seasoned investor or new to the world of capital gains, using a worksheet can simplify the process and ensure you are accurately reporting your gains to the IRS. By organizing your transactions and tracking the cost basis of your assets, you can better understand your overall investment performance and make informed decisions.

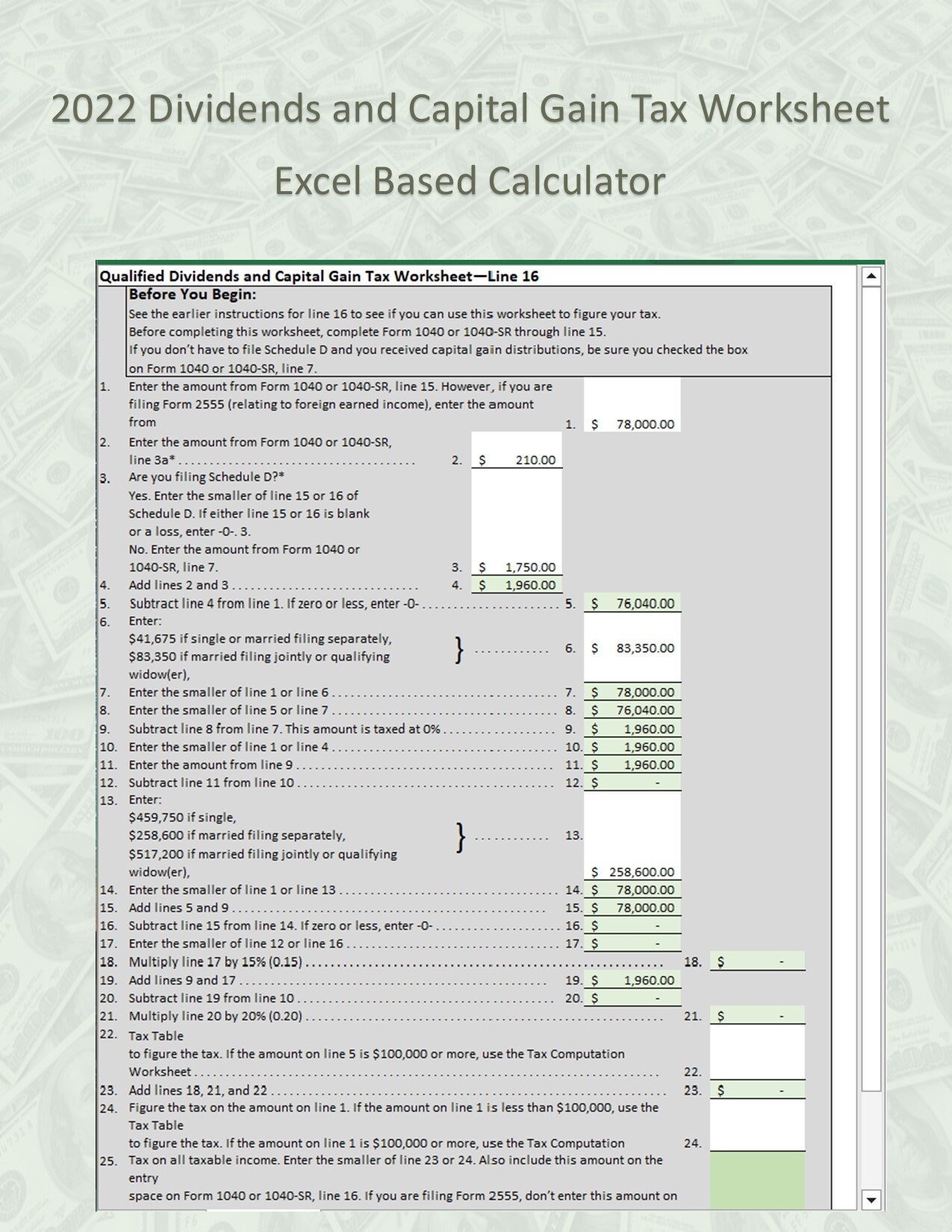

Capital Gains Worksheet

A capital gains worksheet typically includes sections for listing the details of each asset sold, such as the purchase date, sale date, sale price, and cost basis. It also calculates the capital gain or loss for each transaction, taking into account any fees or commissions paid. By inputting this information accurately, you can determine your total capital gains for the year and assess any tax implications.

One of the key benefits of using a capital gains worksheet is the ability to see a clear breakdown of your investment activity. This can help you identify trends, assess the performance of individual assets, and make strategic decisions for future investments. Additionally, having a detailed record of your capital gains can simplify tax filing and potentially reduce the risk of errors or audits.

It is important to update your capital gains worksheet regularly to ensure it reflects the most current information. By staying organized and keeping track of your investment activity, you can better manage your finances and plan for the future. Whether you use a digital spreadsheet or a paper-based worksheet, the key is to maintain accuracy and consistency in your record-keeping.

In conclusion, a capital gains worksheet is a valuable tool for investors looking to track and calculate their investment gains accurately. By using a worksheet, you can better understand your investment performance, assess tax implications, and make informed decisions for the future. Whether you are an experienced investor or just starting out, a capital gains worksheet can help you stay organized and on top of your financial goals.