Managing your finances can be a challenging task, especially when you have multiple expenses to keep track of. One effective way to stay on top of your finances is by using a weekly budget worksheet. This simple tool can help you allocate your funds wisely and ensure that you stay within your budget each week.

By creating a weekly budget worksheet, you can list all your income sources and expenses in one place. This allows you to see where your money is going and identify areas where you may need to cut back. With a clear overview of your finances, you can make informed decisions about how to allocate your funds and prioritize your spending.

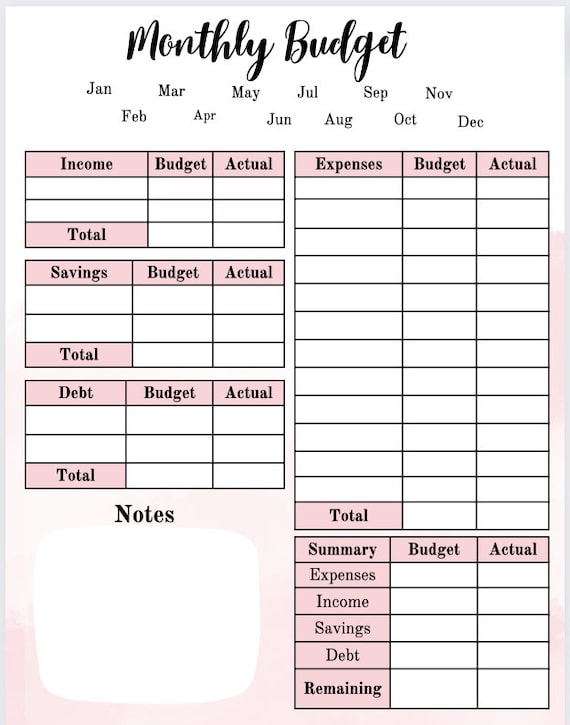

Weekly Budget Worksheet

To create a weekly budget worksheet, start by listing all your sources of income for the week. This can include your salary, freelance work, or any other income you receive. Next, list all your fixed expenses such as rent, utilities, and loan payments. Then, allocate a portion of your income to variable expenses like groceries, entertainment, and transportation.

Once you have listed all your income and expenses, calculate the total amount of money you have coming in and going out each week. This will give you a clear picture of your financial situation and help you determine if you need to make any adjustments to your spending habits. By tracking your expenses on a weekly basis, you can stay accountable and avoid overspending.

It’s important to update your weekly budget worksheet regularly to reflect any changes in your income or expenses. By reviewing your budget each week, you can identify trends in your spending habits and make adjustments as needed. This proactive approach to budgeting can help you achieve your financial goals and build a strong foundation for a secure financial future.

In conclusion, a weekly budget worksheet is a valuable tool for managing your finances and staying on track with your financial goals. By creating a detailed budget that outlines your income and expenses, you can make informed decisions about how to allocate your funds and prioritize your spending. With careful planning and regular updates to your budget worksheet, you can take control of your finances and achieve financial stability.