When it comes to filing taxes, a tax worksheet can be a helpful tool in organizing your financial information. This worksheet allows you to calculate your taxable income, deductions, credits, and ultimately determine how much you owe or are owed by the government. It provides a structured way to gather all necessary information and ensure accuracy in your tax return.

Whether you are self-employed, a freelancer, or have multiple sources of income, a tax worksheet can simplify the process and help you maximize your tax savings. It can also help you identify potential deductions and credits that you may qualify for, reducing your tax liability and increasing your refund.

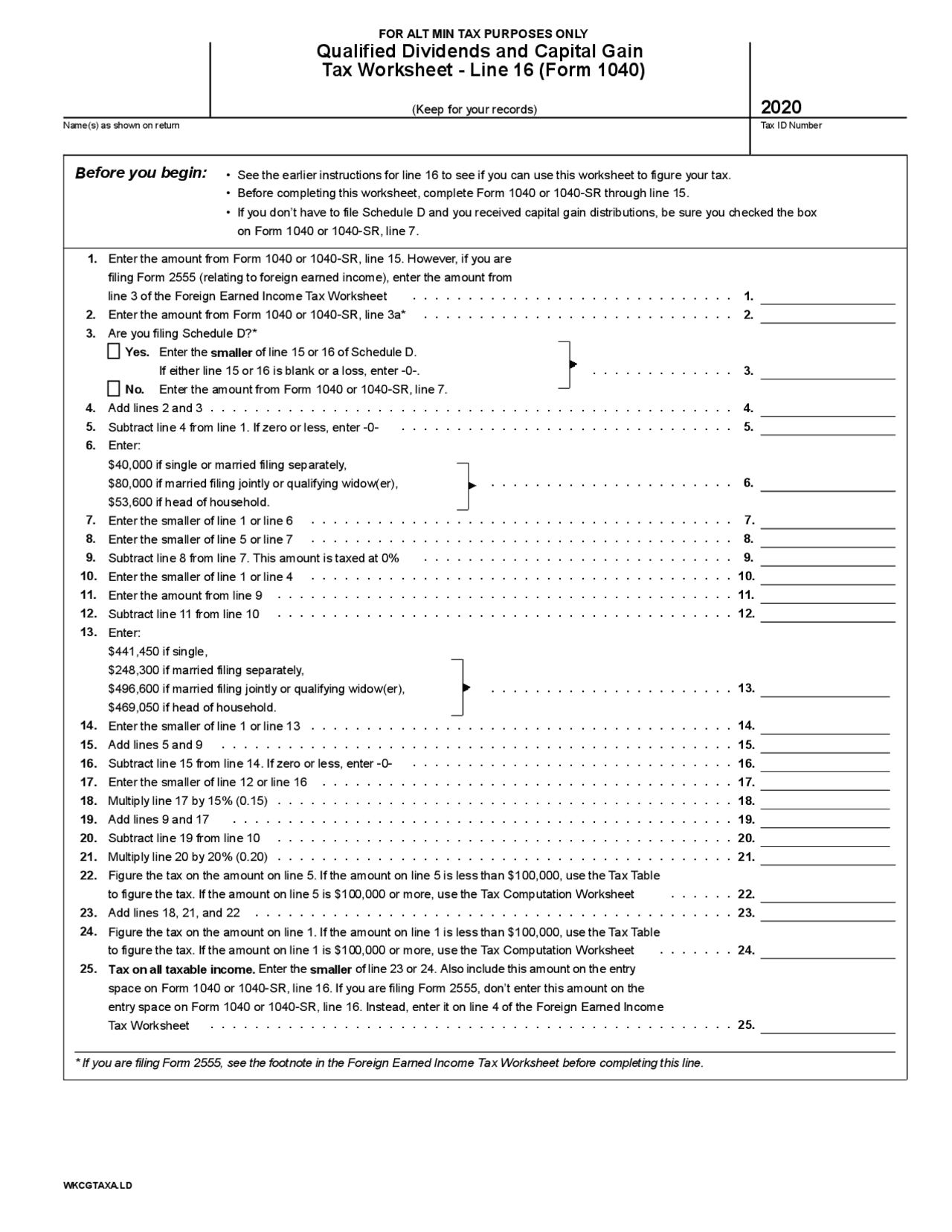

Tax Worksheet

One of the key components of a tax worksheet is calculating your taxable income. This includes adding up all sources of income, such as wages, self-employment income, investment income, and any other earnings. You then subtract any adjustments to income, such as contributions to retirement accounts or student loan interest, to arrive at your adjusted gross income.

Next, the worksheet helps you determine your deductions and credits. This can include standard deductions or itemized deductions, such as mortgage interest, charitable contributions, and medical expenses. You can also calculate any tax credits you may be eligible for, such as the Earned Income Tax Credit or Child Tax Credit.

Once you have calculated your taxable income, deductions, and credits, the tax worksheet helps you determine your tax liability. This is the amount of tax you owe based on your income and filing status. If you have had taxes withheld from your paychecks throughout the year, this amount is subtracted from your tax liability to determine if you owe additional taxes or are entitled to a refund.

In conclusion, a tax worksheet is a valuable tool in preparing your taxes and ensuring accuracy in your return. By using a worksheet to organize your financial information, calculate your taxable income, deductions, and credits, you can maximize your tax savings and potentially increase your refund. Consider using a tax worksheet this tax season to streamline the process and make filing your taxes easier and more efficient.