For individuals who work from home, the IRS offers a home office deduction that can help reduce taxable income. This deduction can be a significant benefit for those who use a portion of their home exclusively for business purposes. However, claiming this deduction requires careful documentation and adherence to IRS guidelines.

One important tool in calculating the home office deduction is the IRS Home Office Deduction Worksheet. This worksheet helps taxpayers determine the amount of expenses they can deduct for their home office, based on factors such as the size of the office space and total household expenses.

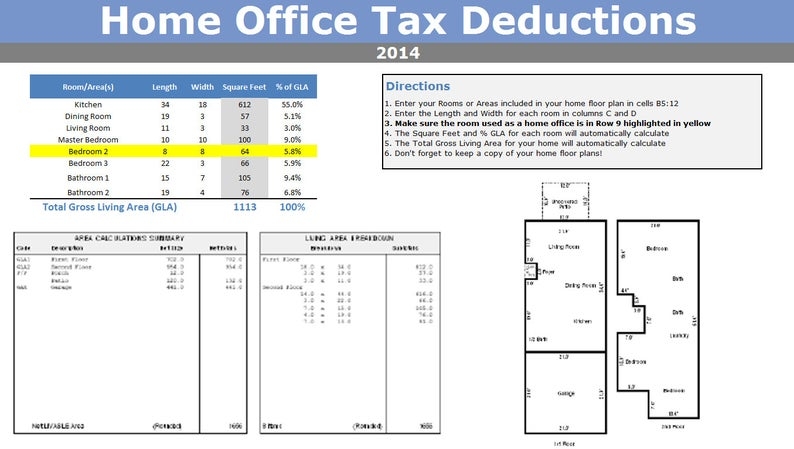

IRS Home Office Deduction Worksheet

The IRS Home Office Deduction Worksheet typically includes sections for recording information such as the square footage of the home office, total square footage of the home, and various expenses related to the home office, such as utilities, insurance, and mortgage interest. Taxpayers are required to provide accurate and detailed information to support their deduction claims.

It is important to note that the IRS has specific rules regarding what qualifies as a home office and how expenses can be allocated. To be eligible for the home office deduction, the space must be used regularly and exclusively for business purposes. Additionally, the deduction is limited to the income generated by the business, and any excess deductions cannot be carried forward to future years.

When completing the IRS Home Office Deduction Worksheet, taxpayers should carefully review the instructions provided by the IRS and ensure that all required information is accurately reported. Failing to comply with IRS guidelines can result in penalties and interest on underpaid taxes.

In conclusion, the IRS Home Office Deduction Worksheet is a valuable tool for individuals who work from home and wish to claim a deduction for their home office expenses. By following IRS guidelines and maintaining detailed records, taxpayers can maximize their deduction while avoiding potential audit issues. It is recommended to consult with a tax professional for assistance in accurately completing the worksheet and claiming the home office deduction.