As tax season approaches, it’s important to familiarize yourself with the various forms and worksheets that may be required when filing your taxes. One such form is the 2021 Form 1040 Schedule D Tax Worksheet, which is used to calculate the capital gains and losses from the sale of assets such as stocks, bonds, and real estate.

For taxpayers who have engaged in any transactions involving capital assets during the tax year, completing the Schedule D Tax Worksheet is essential for accurately reporting these transactions on their tax return. Understanding how to fill out this worksheet can help ensure that you are compliant with IRS regulations and maximize any potential tax benefits or deductions.

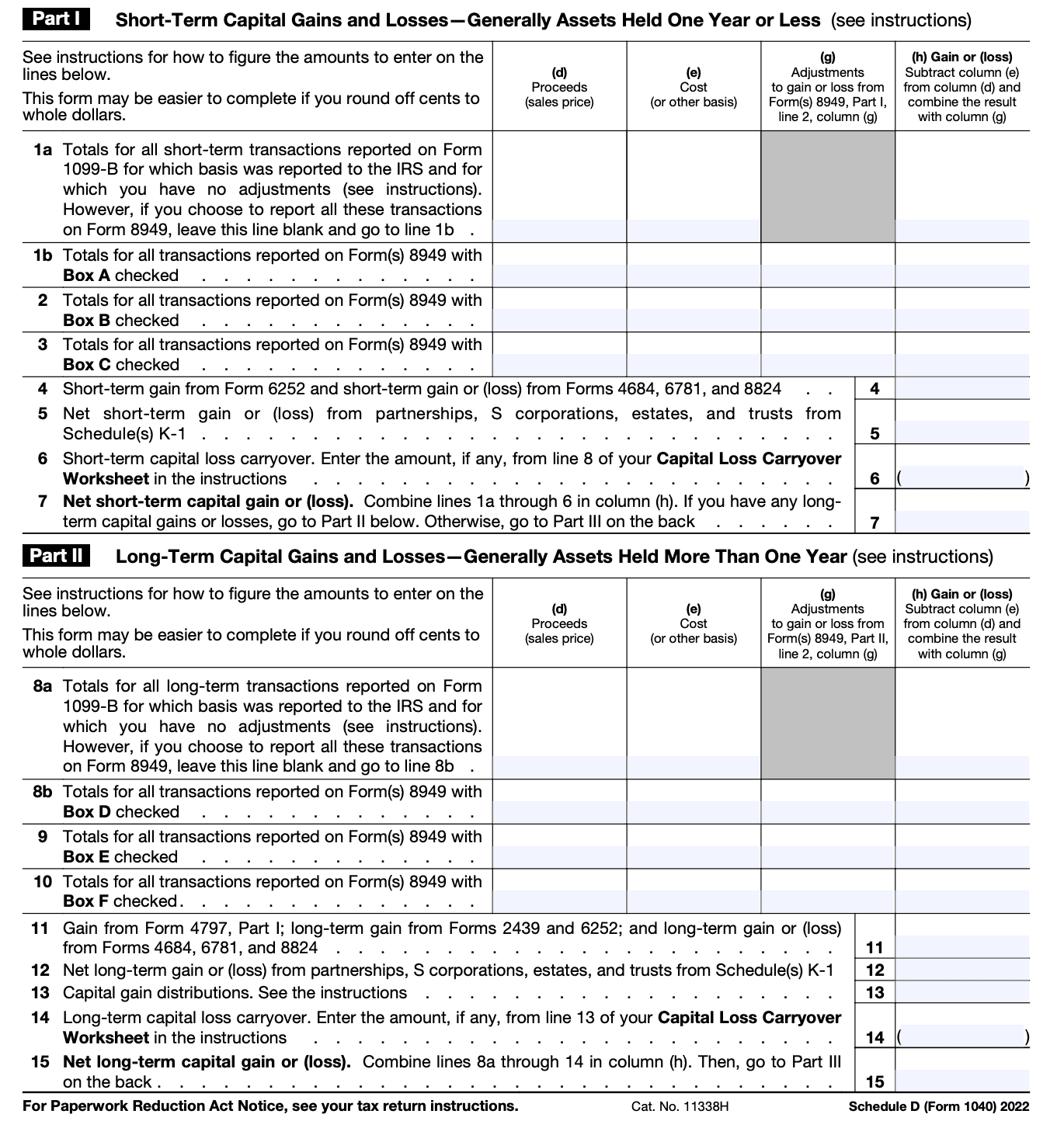

2021 Form 1040 Schedule D Tax Worksheet

The Schedule D Tax Worksheet is divided into several sections, including determining your net capital gain or loss, applying any capital loss carryovers from previous years, and calculating the tax liability on your capital gains. It is important to carefully review the instructions provided with the worksheet to ensure accurate completion.

When completing the worksheet, you will need to gather information such as the sale price of the asset, the cost basis, any adjustments or expenses related to the sale, and the holding period of the asset. This information will be used to calculate the capital gain or loss for each transaction, which will then be totaled to determine your overall net capital gain or loss for the tax year.

Once you have calculated your net capital gain or loss, you will then need to determine the tax rate that applies to your specific situation. Depending on your filing status and total income, the tax rate on capital gains may vary. It is important to consult the current tax brackets and rates provided by the IRS to ensure accurate calculation of your tax liability.

By carefully completing the 2021 Form 1040 Schedule D Tax Worksheet, you can ensure that your capital gains and losses are accurately reported on your tax return. This can help you avoid potential audits or penalties and maximize any tax benefits available to you. If you have any questions or concerns about completing the worksheet, consider consulting a tax professional for assistance.

As tax season approaches, taking the time to understand and complete the 2021 Form 1040 Schedule D Tax Worksheet can help streamline the filing process and ensure compliance with IRS regulations. By accurately reporting your capital gains and losses, you can maximize any potential tax benefits and avoid costly mistakes. Remember to keep all relevant documentation and consult with a tax professional if needed to ensure a smooth tax filing experience.