As homeowners become more aware of the impact their homes have on the environment, the demand for energy-efficient home improvements is on the rise. From installing solar panels to upgrading to energy-efficient appliances, there are many ways to make your home more eco-friendly. However, these upgrades can come with a hefty price tag. Luckily, there are tax credits available to help offset the cost of these improvements.

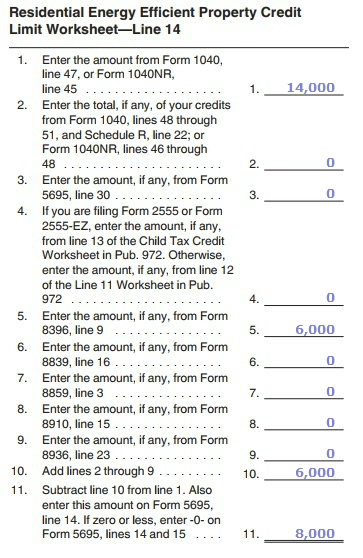

One way to determine the amount of tax credit you may be eligible for is by using an energy-efficient home improvement credit limit worksheet. This worksheet can help you calculate the maximum credit you can claim for the energy-efficient upgrades you make to your home. By filling out this worksheet, you can ensure that you are maximizing the tax benefits available to you.

When filling out the energy-efficient home improvement credit limit worksheet, be sure to include all the eligible improvements you have made to your home. This may include things like insulation upgrades, installation of energy-efficient windows and doors, or the purchase of energy-efficient heating and cooling systems. By accurately documenting these improvements, you can ensure that you are claiming the maximum credit available to you.

In addition to the federal tax credits available for energy-efficient home improvements, many states also offer their own incentives for making your home more energy-efficient. By utilizing these credits in conjunction with the federal tax credits, you can further reduce the out-of-pocket cost of your home upgrades. Be sure to research what credits are available in your state to take full advantage of all the benefits available to you.

Overall, using an energy-efficient home improvement credit limit worksheet can help you maximize the tax benefits available to you for making your home more eco-friendly. By accurately documenting your improvements and taking advantage of both federal and state tax credits, you can make your home more energy-efficient without breaking the bank.

So, if you’re looking to make your home more energy-efficient, be sure to utilize the resources available to you, such as the energy-efficient home improvement credit limit worksheet. By doing so, you can improve your home’s energy efficiency while also saving money on your taxes.