When it comes to taxes, understanding how many withholding allowances you can claim is crucial. The Number of Regular Withholding Allowances Worksheet A helps you determine the correct amount to withhold from your paycheck. This worksheet is used by employees to calculate the number of allowances they are eligible for, which in turn affects the amount of federal income tax that is withheld from their pay.

It is important to accurately fill out this worksheet to avoid overpaying or underpaying your taxes. The goal is to have just the right amount withheld so that you do not owe a large sum at tax time nor receive a big refund. By taking the time to complete Worksheet A, you can ensure that your tax withholding is as accurate as possible.

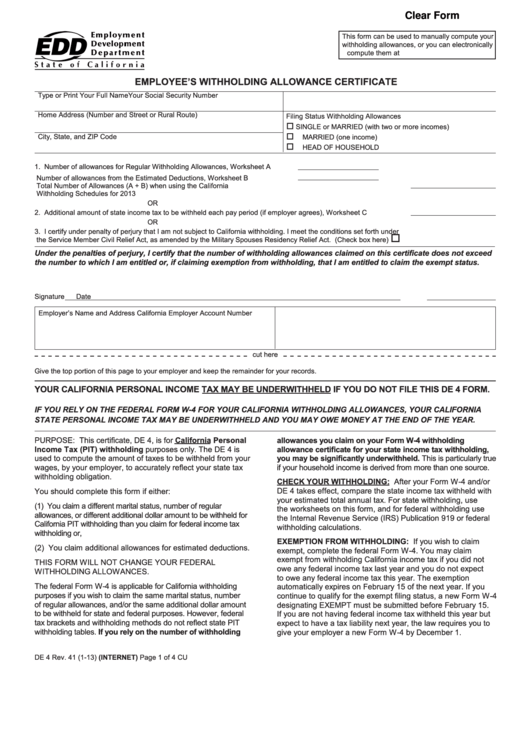

Number of Regular Withholding Allowances Worksheet A

The Number of Regular Withholding Allowances Worksheet A is a simple form that requires you to provide information about your filing status, dependents, and other relevant factors. By answering the questions on the worksheet, you can determine how many allowances you are eligible for. This number is then used to calculate the amount of tax that will be withheld from your paycheck.

One of the key factors that determines the number of allowances you can claim is whether you have dependents. The more dependents you have, the higher your allowances will be. Additionally, your filing status and other deductions can also impact the number of allowances you are eligible for. By carefully considering all of these factors, you can arrive at an accurate number for your withholding allowances.

It is important to review and update your withholding allowances regularly, especially if your financial situation changes. By keeping your allowances up to date, you can ensure that you are not overpaying or underpaying your taxes throughout the year. The Number of Regular Withholding Allowances Worksheet A is a helpful tool that can guide you through this process and help you make informed decisions about your tax withholding.

In conclusion, the Number of Regular Withholding Allowances Worksheet A is a valuable resource for employees who want to ensure that their tax withholding is accurate. By carefully completing this worksheet and reviewing your allowances regularly, you can avoid any surprises at tax time and maintain control over your finances. Make sure to take the time to fill out Worksheet A correctly and consult with a tax professional if you have any questions or concerns.